capital gains tax news uk

The latest breaking news comment and features from The Independent. Our capital gains tax rates guide explains this in more detail.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Chancellor Rishi Sunak made no mention of a one-off wealth tax to help foot the.

. Tax when you sell property. How is UK Capital Gains Tax calculated. In the midst of a year in which theyve delivered historic losses.

Reduce your taxable income. The rate at which you pay Income Tax denotes which rate you pay for Capital Gains Tax. A strange time to talk about capital gains tax on gilts.

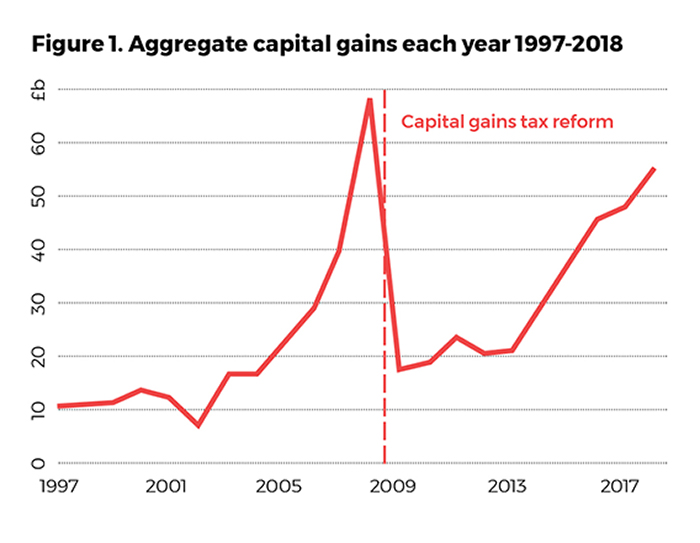

Capital gains have skyrocketed in recent years. A blog on the Cap X site says that whenever politicians are casting around for taxes to increase one hoary old chestnut is the desire. Tax if you live abroad and sell your UK home.

A website that describes itself as promoting popular capitalism is urging the government not to consider raising Capital Gains Tax on landlords and others in this months Autumn Statement. Something else thats increased in value. Work out tax relief when you sell your home.

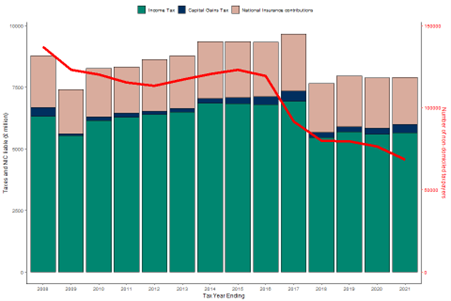

They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained. Make investments in Isas as any gains are tax. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

3 November 2022 534 pm 2-min read. The UK chancellor is considering raising taxes on the sale of assets such as shares and property to fill a 50 billion 56bn. You gain is the difference between what you paid for your property and the amount you get when you sell or dispose of it.

Record amount paid by investors which is likely to increase in the coming years. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. What you need to do.

The Chancellor is looking at raising taxes on the sale of assets such as shares and property as he weighs up difficult decisions to. By Harry Brennan 5 Aug 2021. UK considers cutting tax-free dividend allowance increasing capital gains tax -media Reuters 2317 3-Nov-22.

Tell HMRC about Capital Gains Tax on UK. Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. Capital gains tax take hits 10bn use these tricks to pay less.

Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. The Resolution Foundation think-tank warned earlier this week that without spending cuts or tax rises the Governments deficit could soar to 89bn by 2026-27. News stories speeches letters and notices.

How you report and pay your Capital Gains Tax depends whether you sold. In the last 7 days. Jeremy Hunt is considering raising capital gains tax and slashing the dividend allowance as he seeks to fill the 50bn chasm in the nations finances reports suggest.

Tax when you sell your home. First deduct the Capital Gains tax-free allowance from your taxable gain. Beta V10 - Powered by automated translation.

Capital gains tax cut will benefit. A residential property in the UK on or after 6 April 2020. Everyone has an annual capital gains tax allowance or annual exempt amount in HMRC-speak.

Capital Gains Tax is expected to raise 15 billion this tax year which is approximately 15 of the Treasurys total intake according to the report by The Office for. In your case where capital gains from shares were 20000 and your total annual earnings were 69000. This allowance is 12300 as of 6 April 2022.

If your total taxable gains minus. Add this to your taxable. Capital Gains Tax Threat - government told not to raise it.

Brewers pick up 10M option on Wong for 2023. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015.

What S New Bulletin August 2022

Capital Gains And Hidden Inequality

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Capital Gains Tax Rate Should Double Says Government Review Bbc News

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

What S Sunakism Watch The Capital Gains Tax Rate

Understanding The Order Of Tax M G Wealth

Avoiding Capital Gains Tax On Property Uk Reduce Capital Gains Tax

What Is The Capital Gains Tax The Motley Fool

Guardian Financial Page Newspaper Headline Article 12 November 2020 Capital Gains Tax Overhaul Could Raise 14bn Review In London England Uk Stock Photo Alamy

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Guardian Financial Page Newspaper Headline Article 12 November 2020 Capital Gains Tax Overhaul Could Raise 14bn Review In London England Uk Stock Photo Alamy

30 Day Deadline For Reporting And Paying Capital Gains Tax On The Sale Of Uk Residential Property To Hmrc Johnston Smillie

Progressives Tax The Rich Dreams Fade As Democrats Struggle For Votes Wsj

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Guardian Financial Page Newspaper Headline Article 12 November 2020 Capital Gains Tax Overhaul Could Raise 14bn Review In London England Uk Stock Photo Alamy

Capital Gains Tax Reporting Deadline Extends To 60 Days For Uk Residential Disposals Our Latest Blogs News