when are property taxes due in williamson county illinois

Make sure you have your parcel number. 138 of home value.

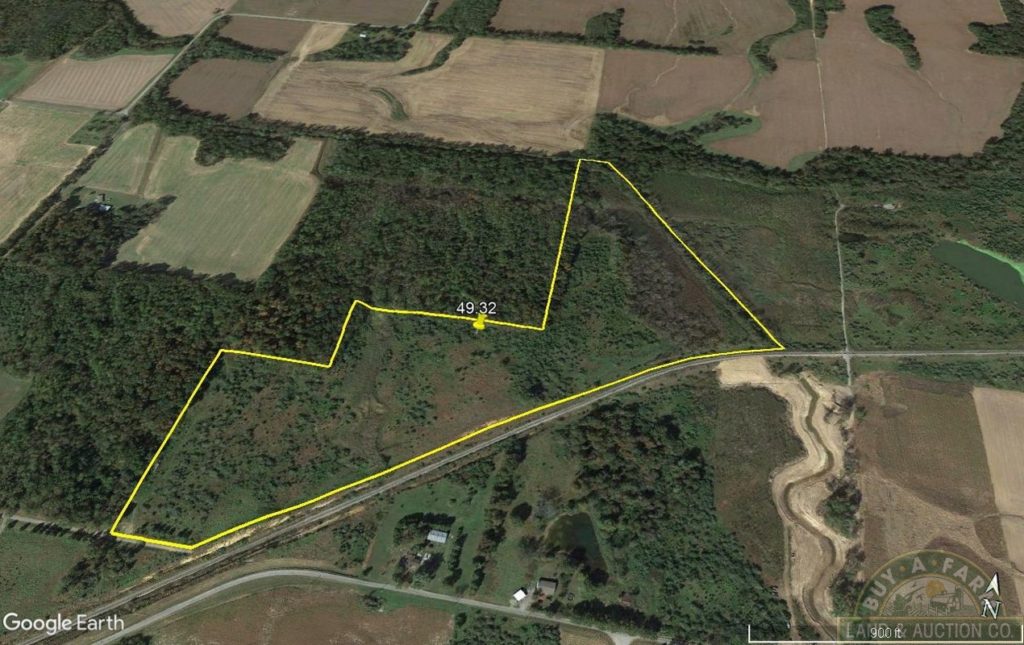

59 Acres Williamson County Il Farmland Farm Tillable Barn Timber 2400l Buy A Farm Land And Auction Company

You can call the Williamson County Tax Assessors Office for assistance at 618-997-1301-Ext142.

. Market value has been defined by The Supreme Court as the sale. 2021 Property Tax Information. M-F 800am - 400pm.

County boards may adopt an accelerated billing method by resolution or ordinance. Call the Williamson County Clerk at 618-998-2110 and ask for an Estimate of Redemption. Yearly median tax in Williamson County.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Williamson County Supervisor of Assessments Office. This exemption does not freeze your tax rate.

Mail received after the due date and without a valid postmark cannot be accepted as proof of on-time payment. In most counties property taxes are paid in two installments usually June 1 and September 1. Marion Illinois 62959.

Tax amount varies by county. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. See detailed property tax information from the sample report for 4133 Lagrande Trce Williamson County IL.

A USPS postmark date of 22822 will be accepted as proof of timely payment. These records can include Williamson County property tax assessments and assessment challenges appraisals and income taxes. THE APPLICATION DEADLINE FOR 2021 is April 5 th 2022.

Taxes 2022 Williamson TN 2022 Williamson TN. 618 997 1301 Phone The Williamson County Tax Assessors Office is located in Marion Illinois. 2021 property taxes must be paid in full on or before Monday January 31 2022 to avoid penalty and interest.

The median property tax in Williamson County Illinois is 1213 per year for a home worth the median value of 87600. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Get driving directions to this office.

The median property tax also known as real estate tax in Williamson County is 121300 per year based on a median home value of 8760000 and a median effective property tax rate of 138 of property value. Williamson County collects on average 138 of a propertys assessed fair market value as property tax. The median property tax on a 8760000 house is 120888 in Williamson County.

Williamson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Williamson County Illinois. 2021 property taxes must be paid in full on or before Monday January 31 2022 to avoid penalty and interest. Tax Collection Schedule - Williamson County Illinois Tax Collection Schedule Home Tax Collection Schedule 2018 - 2019 Real Estate Tax Collection Schedule March 7 Sent off final abstract May 3 Co Clerk Extends Taxes May 28 Mail Tax Bills July 11 1st Installment Due July 12 Sept 1215 Penalty on 1st Installment.

This exemption freezes the assessment on your property if your total household income is 6500000 or less. If you have general questions you can call the. 2021 Property tax statements will be mailed the week of October 18th.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Property tax in Illinois is imposed by local government taxing districts eg school districts municipalities counties and administered by local officials. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Please call the assessors office in Marion before you send documents or if you need to schedule a meeting. Illinois is ranked 1156th of the 3143 counties in the United States in order of the. Please remember that the county is not selling the property at the sale but rather the unpaid.

The median property tax on a 8760000 house is 151548 in Illinois. According to Illinois State Statute the County Treasurer must hold an annual tax sale to sell unpaid property taxes. It freezes the assessed valuation that appears on your tax bill.

Interest is added at the rate of 1-12 per month for delinquent taxes or any fraction thereof after penalty dates until tax is sold or forfeited. 173 of home value. Certain types of Tax Records are available.

Banks cannot collect delinquent tax. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program.

200 West Jefferson Street. 2021 Property tax statements will be mailed the week of October 18th. 407 N Monroe Marion IL 62959 Phone.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. A 1000 cost will be added for. 2021 Williamson County property taxes are due by February 28 2022.

Failure to receive a tax bill will not relieve the tax payer of penalties accruing if taxes are not paid before the penalty date. Welcome to Property Taxes and Fees. Click here for mobile version.

Williamson County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. This exemption must be renewed annually.

First-time applicants can obtain forms from the County Assessors Office. The median property tax on a 8760000 house is 91980 in the United States.

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Treasurer To Send Out Real Estate Tax Bills Friday Withers Broadcasting Webq Am Fm

History Williamson County Illinois

Online Real Estate Auction Williamson County Il 133 Acres 1 Tract 2683a Buy A Farm Land And Auction Company

For Sale 49 Acres Williamson County Il Recreational Deer Duck Waterfowl Hunting 2448l Buy A Farm Land And Auction Company

View Pay Property Taxes Williamson County Illinois

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

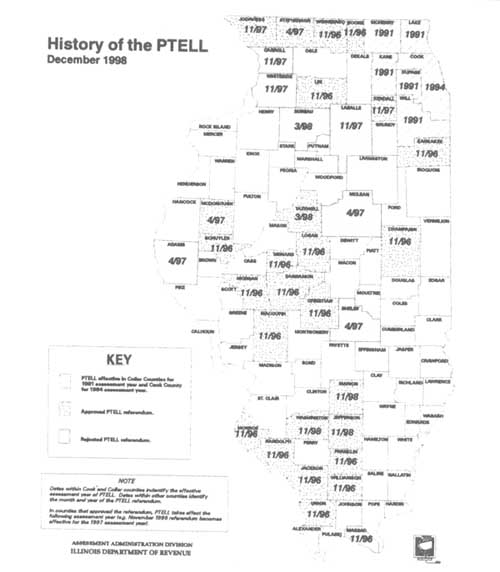

Surviving Property Tax Caps In Illinois Public Libraries

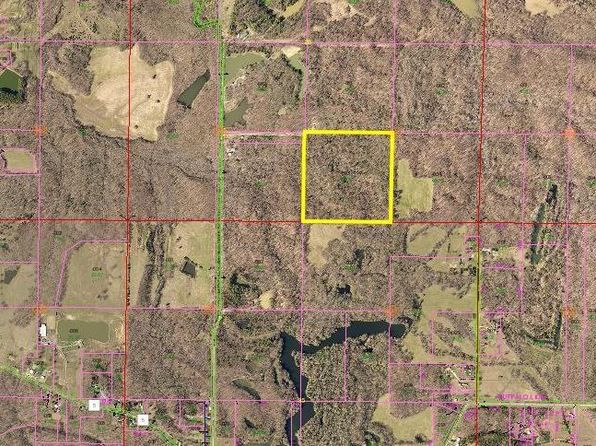

Pittsburg Williamson County Il Farms And Ranches Recreational Property Hunting Property For Auction Property Id 412733493 Landwatch

Williamson County Illinois Home County Seat Of Williamson County

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Online Real Estate Auction Williamson County Il 133 Acres 1 Tract 2683a Buy A Farm Land And Auction Company

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Recently Sold Homes In Williamson County Il 2 547 Transactions Zillow

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Online Real Estate Auction Williamson County Il 133 Acres 1 Tract 2683a Buy A Farm Land And Auction Company

For Sale 240 Acres Williamson County Il Hunting Recreation Wooded Tillable Ponds 2292l Buy A Farm Land And Auction Company

Circuit Clerk Williamson County Illinois

Williamson County Illinois Home County Seat Of Williamson County